In recent years, the world of decentralized finance (DeFi) has experienced significant growth and innovation. One area that has gained considerable attention is the integration of decentralized oracle networks with DeFi insurance. Decentralized oracle networks play a crucial role in providing reliable and trustworthy data to smart contracts, enabling the automation of various financial services. This article will delve into the concept of decentralized oracle networks and explore their impact on the field of DeFi insurance.

Introduction to Decentralized Oracle Networks

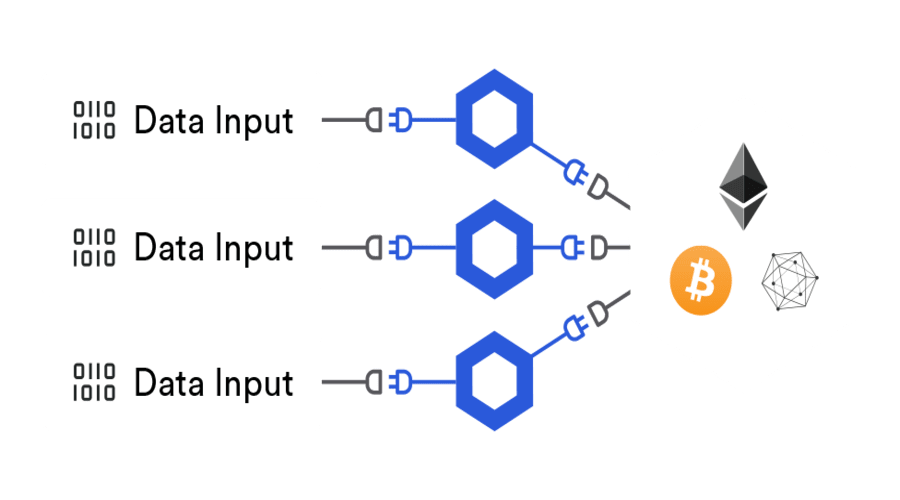

Decentralized oracle networks serve as a bridge between the real world and blockchain applications. They provide access to external data, enabling smart contracts to interact with off-chain information. These networks ensure that data inputs used by smart contracts are reliable and tamper-resistant, establishing trust and transparency within the blockchain ecosystem.

Understanding DeFi Insurance

DeFi insurance refers to the provision of insurance coverage for decentralized financial applications. In traditional finance, insurance plays a vital role in mitigating risks and protecting against losses. Similarly, DeFi insurance aims to provide protection against vulnerabilities and exploits within the decentralized ecosystem.

The Need for Reliable Data in DeFi

Accurate and reliable data is crucial for the proper functioning of DeFi protocols. Smart contracts rely on real-time information to execute financial transactions, determine asset prices, and assess risks. However, acquiring trustworthy data from external sources presents a challenge in the decentralized landscape.

Role of Decentralized Oracle Networks in DeFi Insurance

Decentralized oracle networks play a pivotal role in DeFi insurance by providing the necessary data inputs for insurance policies. These networks enable secure and decentralized data feeds, ensuring that the information used for risk assessment and claims processing is accurate and verifiable.

How Decentralized Oracle Networks Work

Decentralized oracle networks operate through a decentralized consensus mechanism, leveraging a network of nodes to fetch and verify data from various sources. These nodes aggregate and validate data before delivering it to smart contracts. This process ensures data integrity and guards against manipulation or fraud.

Benefits of Decentralized Oracle Networks in DeFi Insurance

Decentralized Oracle Networks (DONs) play a significant role in the realm of decentralized finance (DeFi) insurance. These networks provide a range of benefits that enhance the efficiency, security, and reliability of DeFi insurance processes. Here are the key benefits of decentralized oracle networks in DeFi insurance:

- Enhanced Security: DONs reduce the reliance on centralized authorities, mitigating the risk of single points of failure. By distributing data retrieval and validation across multiple nodes, they make it difficult for malicious actors to manipulate or tamper with the data used in insurance contracts.

- Reliable Data Feeds: Decentralized oracle networks access data from various reliable sources, cross-reference and validate it, ensuring accurate and trustworthy information for risk assessment, policy pricing, and claims settlement. This reliability enhances the overall integrity of the insurance ecosystem.

- Automation and Efficiency: Integration with DONs enables automation of insurance processes, reducing manual intervention. Smart contracts can automatically trigger policy payouts based on predefined conditions, streamlining claims settlement and improving operational efficiency.

- Real-Time Data Access: DONs provide real-time access to external data, allowing DeFi insurance protocols to react swiftly to changes in market conditions and events that impact policy coverage. This timeliness enhances the effectiveness of risk assessment and improves the responsiveness of insurance policies.

- Transparency and Trust: Decentralized oracle networks promote transparency by making the data feeds and data sources publicly accessible. This transparency fosters trust among participants in the DeFi insurance ecosystem, as the information used for policy underwriting and claims processing is verifiable and auditable.

- Scalability: DONs offer scalability, allowing DeFi insurance protocols to handle a growing number of users and transactions without sacrificing performance. The distributed nature of these networks enables parallel processing and efficient data retrieval, ensuring smooth scalability as the demand for DeFi insurance increases.

- Cross-Chain Interoperability: Some decentralized oracle networks support cross-chain interoperability, enabling the exchange of data between different blockchain networks. This interoperability expands the reach of DeFi insurance protocols and facilitates seamless integration with various blockchain ecosystems.

- Innovation and New Insurance Products: By leveraging decentralized oracle networks, DeFi insurance protocols can explore innovative insurance products such as parametric insurance, where payouts are triggered based on predetermined conditions. This opens up new opportunities for customized insurance offerings within the decentralized landscape.

Challenges and Risks

- Data Quality: Ensuring the accuracy and reliability of data from external sources is a significant challenge. Data feeds obtained by DONs may be prone to inaccuracies, manipulation, or even malicious attacks. This can lead to incorrect risk assessments, policy pricing, and claims settlements.

- Security Vulnerabilities: Decentralized oracle networks are not immune to security vulnerabilities. Malicious actors may attempt to compromise the nodes that provide data or manipulate the data feeds, potentially leading to financial losses for DeFi insurance participants.

- Network Connectivity: The reliance of decentralized oracle networks on external data sources introduces a dependency on their availability and connectivity. Network outages, disruptions, or delays in data retrieval can impact the proper functioning of DONs and the timely execution of insurance processes.

- Centralized Dependencies: Some decentralized oracle networks may have centralized dependencies, such as a single point of failure or a small number of trusted data providers. This introduces a risk of data manipulation or censorship, which contradicts the core principles of decentralization.

- Regulatory Compliance: DeFi insurance protocols that rely on decentralized oracle networks may face regulatory challenges. Compliance with existing insurance regulations, data privacy laws, or anti-money laundering (AML) requirements can pose hurdles and require careful navigation.

- Economic Incentives: Ensuring economic incentives for participants in decentralized oracle networks is crucial. Proper tokenomics and rewards mechanisms must be implemented to incentivize node operators to provide accurate data, maintain network security, and ensure the long-term sustainability of the network.

- Adoption and Integration: Integrating decentralized oracle networks into existing DeFi insurance protocols and platforms may require technical expertise and resources. Encouraging adoption among insurance providers, developers, and users is essential for the widespread implementation and success of DONs in DeFi insurance.

Addressing these challenges and mitigating the associated risks is vital for the continued development and adoption of decentralized oracle networks in DeFi insurance. Through ongoing research, innovation, collaboration, and adherence to best practices, the DeFi community can overcome these obstacles and unlock the full potential of DONs to revolutionize the insurance industry within the decentralized ecosystem.

Future Outlook and Potential Applications

- Parametric Insurance: DONs can facilitate the development of parametric insurance products within the DeFi space. Parametric insurance relies on predefined triggers, such as specific weather conditions or market fluctuations, to automatically initiate policy payouts. DONs can provide real-time data feeds that enable accurate and transparent assessments of these triggers, streamlining the claims settlement process.

- Cross-Chain Interoperability: Interoperability is a crucial aspect of the DeFi landscape, and DONs can play a pivotal role in facilitating cross-chain data exchange. By connecting different blockchain networks, DONs enable seamless data transfer and interaction between DeFi insurance protocols on various platforms. This interoperability expands the reach and functionality of DeFi insurance, creating a more connected and efficient ecosystem.

- Decentralized Risk Assessment: DONs have the potential to revolutionize risk assessment methodologies within DeFi insurance. By leveraging real-time and reliable data feeds, DONs can enhance risk modeling and assessment processes, improving the accuracy of underwriting and pricing. This enables the creation of more tailored insurance products and pricing structures that align with the specific risks present in the decentralized ecosystem.

- Liquidity Provision and Insurance Pooling: DONs can facilitate the creation of liquidity pools and insurance coverage for specific DeFi protocols or platforms. These pools allow participants to provide liquidity in exchange for premium payments, creating a decentralized insurance marketplace. DONs can verify and validate the data needed for assessing risks and claims, ensuring transparency and trust within these pools.

- Expanding Insurance Offerings: With the integration of DONs, DeFi insurance can expand beyond traditional coverage types. The flexibility and programmability of smart contracts, combined with reliable data inputs from DONs, enable the development of innovative insurance products tailored to DeFi-specific risks, such as flash loan protection, smart contract failure coverage, or impermanent loss compensation.

- Insurance Aggregation Platforms: DONs can serve as the backbone of insurance aggregation platforms within the DeFi space. These platforms consolidate insurance options from multiple protocols and providers, offering users a comprehensive and simplified way to compare and select insurance coverage. DONs ensure the accuracy and reliability of the data used in these platforms, fostering transparency and confidence among users.

Conclusion

Decentralized oracle networks have revolutionized the world of DeFi insurance by providing reliable and verifiable data inputs. These networks enhance security, increase efficiency, and open up new possibilities for innovative insurance products within the decentralized ecosystem. As the DeFi industry continues to evolve, the integration of decentralized oracle networks will play a pivotal role in shaping its future.

FAQs (Frequently Asked Questions)

- What is a decentralized oracle network? A decentralized oracle network is a system that fetches and verifies data from external sources, providing reliable data inputs to smart contracts within the blockchain ecosystem.

- Why is reliable data important in DeFi insurance? Reliable data is crucial in DeFi insurance as it ensures accurate risk assessment, fair claims settlements, and overall trust within the decentralized ecosystem.

- What are the benefits of decentralized oracle networks in DeFi insurance? Decentralized oracle networks enhance security, provide reliable data sources, and enable automation and efficiency in DeFi insurance processes.

- What challenges do decentralized oracle networks face? Decentralized oracle networks face challenges such as data quality, security vulnerabilities, and network connectivity issues.

- What is the future outlook for decentralized oracle networks in DeFi insurance? The future of decentralized oracle networks in DeFi insurance is promising, with potential applications including parametric insurance and cross-chain interoperability.

I’m a prolific crypto blogger who is known for his expertise in the field of cryptocurrencies, blockchain technology, and the decentralized economy. I have written extensively on these topics, providing valuable insights and analysis to his readers.